Future Returns

The role of timing and luck is underappreciated in financial planning and portfolio management. Prevailing market conditions during the time frame when you start saving, when you retire and when you begin portfolio distributions are impactful (good and bad) on future outcomes.

Ray Dalio did an interview with Henry Blodgett from Business Insider last week that I thought was really important for investors to hear. Dalio, who manages the largest hedge fund in the world, had strong opinions on what portfolio returns could look like in the near future.

Dalio: “You can expect that your investment returns are going to be very low. You can know that. You can certainly know that in the bond and all assets price off that bond return.”

Blodgett: So, intelligent investors when they look at their retirement portfolio, should not be counting on 10% average returns for the next ten years?

Dalio: Right. They should expect to be receiving something in the vicinity of 3% or 4%.

This is not breaking news. Jack Bogle has made similar claims about future investment returns. As has Larry Fink. The arguments for lower returns are all reasonable - low bond yields, stock market valuations, demographics, debt levels etc.

I’m not here to argue whether lower returns will or will not come to fruition. I’m here to expand on how investors should be processing this possibility.

Achieving financial independence is based on accumulating enough wealth to support future spending needs. A crucial input into that calculation is the assumed future portfolio return. Investors who are asking, “am I ok or, do I have enough” need to consider the possibility that they will not earn a 7-10% return on their portfolio over the next five or ten years. And the truth is, this always needs to be considered as a possibility - not just when the Ray Dalios of the world are bringing it to light.

There are habits and tools that are timeless and have historically served investors well during any type of market environment. It doesn’t guarantee anything, but is certainly a better alternative than having blinders on and believing that assumed returns are inevitable.

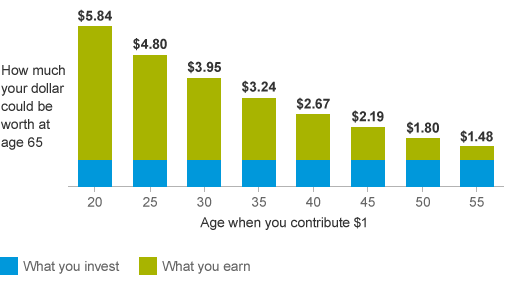

Save more & save earlier: Advice to save more may not be the most optimistic – yet it could turn out to be the most realistic. It allows you to be less reliant on portfolio returns to accumulate wealth. As the chart below from Vanguard shows, the earlier you start, the less of your own dough you'll need to save.

Hypothetical illustration assumes an annual 4% return after inflation. Figures are in today's dollars. The illustration doesn't represent any particular investment.

I get it - it’s really hard to save now for later. Everyone has a lot of near-term obligations on their plate. But the cost to wait is unquestionably far greater.

Expenses: The wealth necessary to support future spending needs is a direct function of how much goes out the door every month. Financial success comes down to successfully matching up assets and liabilities. Have you really identified what those future liabilities look like? Without an accurate number, it’s impossible to determine how much wealth accumulation is necessary.

Diversification: I believe the next line is the most important in the post. The most dangerous reaction to a potential period of low returns would be to increase portfolio risk in a reach for higher yield and returns. A high-yield bond, floating rate bond, master limited partnership or dividend paying stock is not the equivalent of a United States Treasury Bond. Those investments are not inherently bad - it's just not accurate to communicate that they are being used as a T-Bond substitute.

Additionally, do not abandon areas of the investing universe that have under performed over the last decade (Europe, Japan, emerging markets, etc.) Rebalance the portfolio regularly with a rules-based approach and be conscious of fees.

Prepare for Course Corrections: What contingencies are up for discussion? What are you willing to sacrifice? Working a few more years? Spending a little less in retirement? Leaving less to the kids? Paying for less of their college? Saving more today? Part-time consulting work in retirement?

Delay the Social Security Benefit: A benefit 25% higher at 66 (assumed full retirement age) compared to 62. An additional 32% increase in your benefit for earning delayed retirement credits from 66 until 70. If we are, in fact, in store for a lower market returns and you are concerned about outliving your money, it’s tough to argue against delaying Social Security. Full disclosure - this decision is specific to each individual and needs to be made in context of a comprehensive plan.

Above all else, committing to the process of planning gives you the opportunity to make the adjustments needed to stay on track. Having lower expectations for future investment returns could be your best course of action. Worst case, return assumptions are underestimated and you end up with a larger portfolio than you planned for. We all can live with that.

You can hear the interview with Ray Dalio here.

--

Sources:

JPM Guide to the Markets

Business Insider

Ssa.gov

CNBC

Vanguard