A December to Remember

So much for a Santa Claus rally. The stock market is in a downtrend, and it has been ugly (but not unprecedented.) Since the GFC, the economy has slowed several times, each resulting in a market pullback. That said, where we go from here is unknown. As you may expect, I have a few thoughts.

1.) There is not a single cause

Most investors want a single explanation why their portfolio went down. Unfortunately, there is no shortage of people to provide them with one. It's tariffs. The Fed. A slowing economy. Political turmoil. Sentiment. Trend. Technicals. The plunge protection team. Yield curves. Government shutdowns.

Run from anyone who is trying to feed you this reasoning. Not a single one of these factors are the source of market performance (good or bad.) Extrapolating any singular factor into your portfolio decision-making is asking for trouble.

In Antifragile, Taleb writes the following:

"With complex systems, interdependencies are severe. You need to think in terms of ecology; if you remove a specific animal you disrupt a food chain; its predators will starve and its prey will grow unchecked, causing complications and series of cascading side effects. Lions are exterminated by the Canaanites, Phoenicians, Romans, and later inhabitants of Mount Lebanon, leading to the proliferation of goats who crave tree roots, contributing to the deforestation of mountain areas, consequences that were hard to see ahead of time. Likewise, if you shut down a bank in New York, it will cause ripple effects from Iceland to Mongolia. In the complex world, the notion of 'cause' itself is suspect; it is either nearly impossible to detect or not really defined - another reason to ignore newspapers, with their constant supply of causes for things."

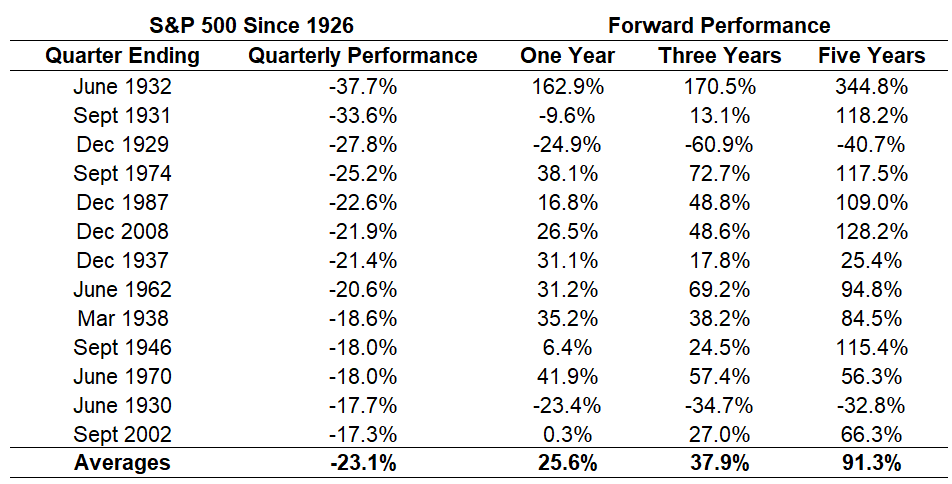

2.) Future returns will usually skew higher

Before running for the hills and turning temporary declines into permanent losses, consider the impact that poor quarterly performance tends to have on future performance. Outside of the Great Depression, the track record leaves one optimistic.

3.) Don't get caught in between

Reacting as you go isn't a plan. Delegating to someone that I would not consider a real financial adviser is short changing oneself. Not selling employer stock because a co-worker didn't isn't going to work. Jumping in and out of the market is a terrible idea. The leakage may be slow and barely noticeable, but the opportunity cost of these decisions is very real.

"The worst kind of problem is precisely the kind of problem we’re not spending time worrying about. It’s not the cataclysmic disaster, the urgent emergency or the five-alarm fire. No, the worst kinds of problems are chronic. They grow slowly over time and are more and more difficult to solve if we wait."

By addressing a chronic issue, you'll remember December 2018. Not for the worst December performance in nearly ninety years, but as a turning point for your financial well-being. I can assure you that this stuff is worth doing right.

--

Sources:

Economic Research Cycle Institute

Antifragile (Nassim Nicholas Taleb)

Buying When Stocks Are Down Big (A Wealth of Common Sense - Ben Carlson)

Chronic (Seth Godin)